The Repo Market in 2025 and Early 2026:

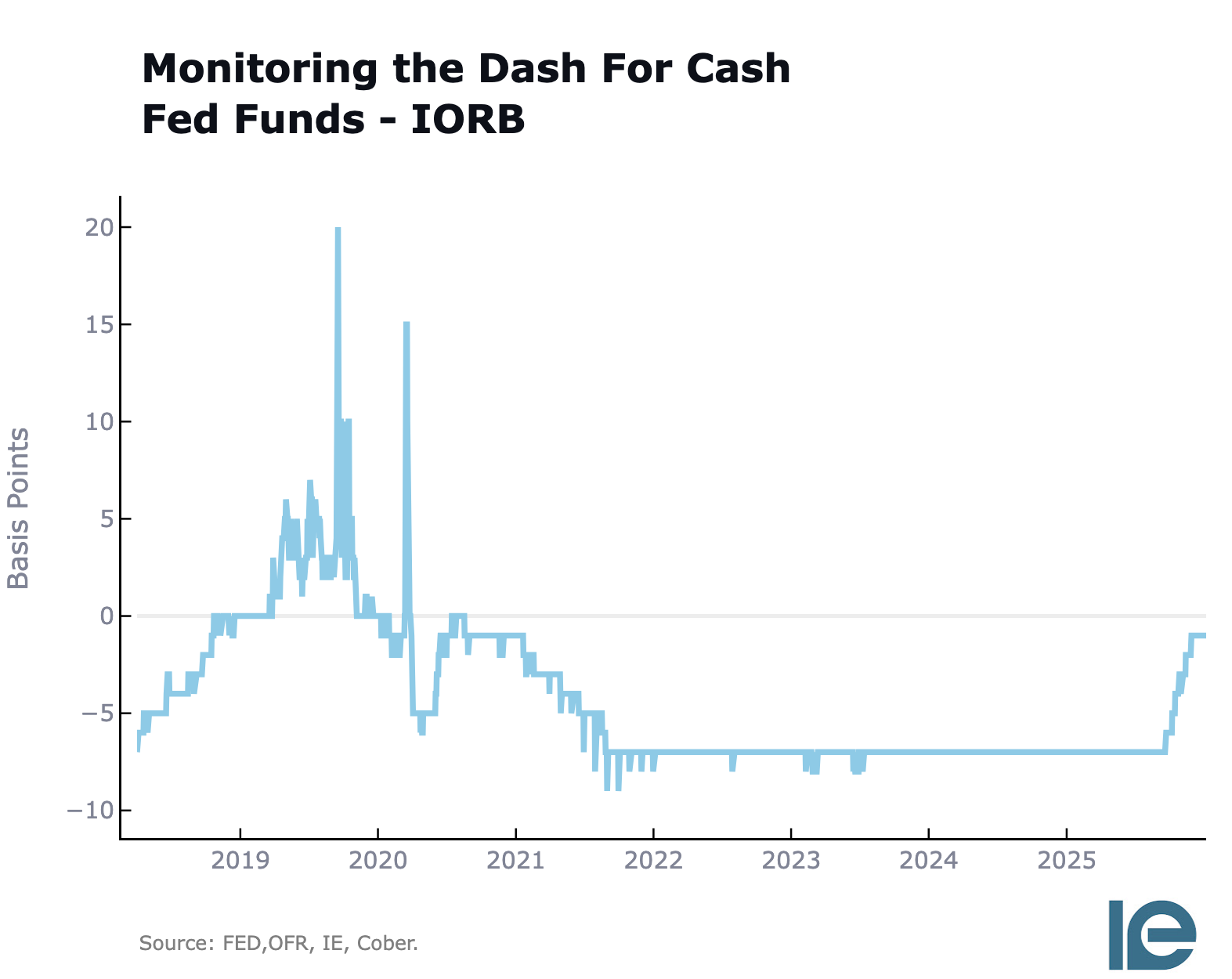

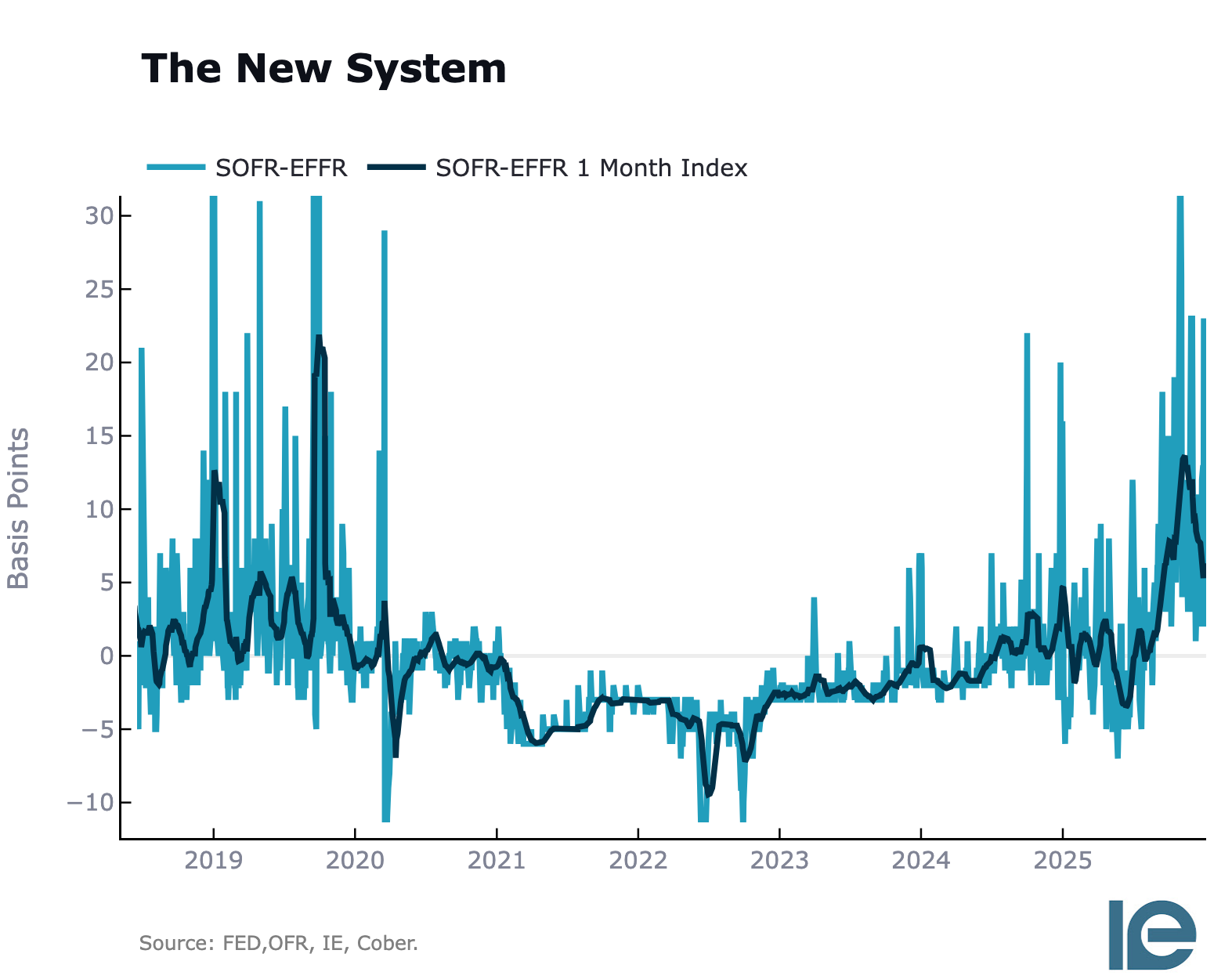

After quantitative tightening drained the system throughout the year and the overnight reverse repo facility emptied, we finally arrived at conditions where banks and dealers are scrambling for cash at quarter ends, EFFR-IORB opportunities that sat untouched for years narrowed to 1 bps, and interest rates are routinely breaking through what are supposed to be the ceilings.

This isn't a crisis, but it's not normal either.

The Arbitrage That Vanished

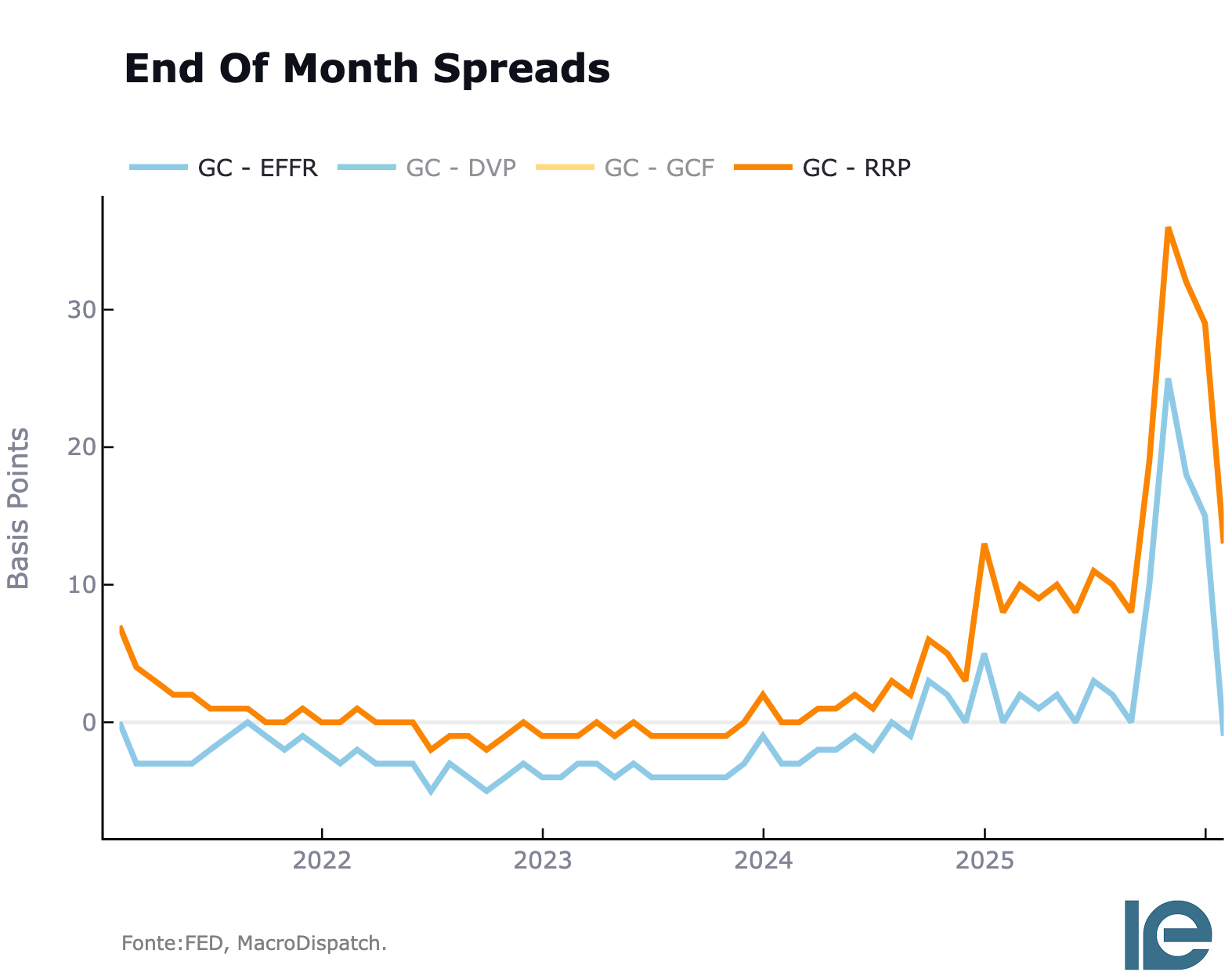

The cleanest signal came from the most stable spread from 2022 through the end of 2024. Foreign banks earned a steady 7-basis-point by borrowing at FED FUNDS from the Federal Home Loan Bank and lending and parking them at IORB at the FED. This spread just sat there, barely moving, for years. Then, in the second half of 2025, it compressed to one basis point.

This matters because that arbitrage represented the most marginal reserves in the system, cash that literally had nowhere better to go; this was the only possible application for it.

When the spread collapses, it means those reserves are finally bidded away. Someone needs them badly enough to pay up to make FHLB use the reserve for other functions in the system.

Roberto Perli at the New York Fed calls this our best gauge for reserve tightness.

This isn't a model or a theory.

It's market participants with real money showing you that reserves are scarce, just as was the case with abundant cash when the RRP was a multi-trillion facility.

The Ceiling That Never Worked

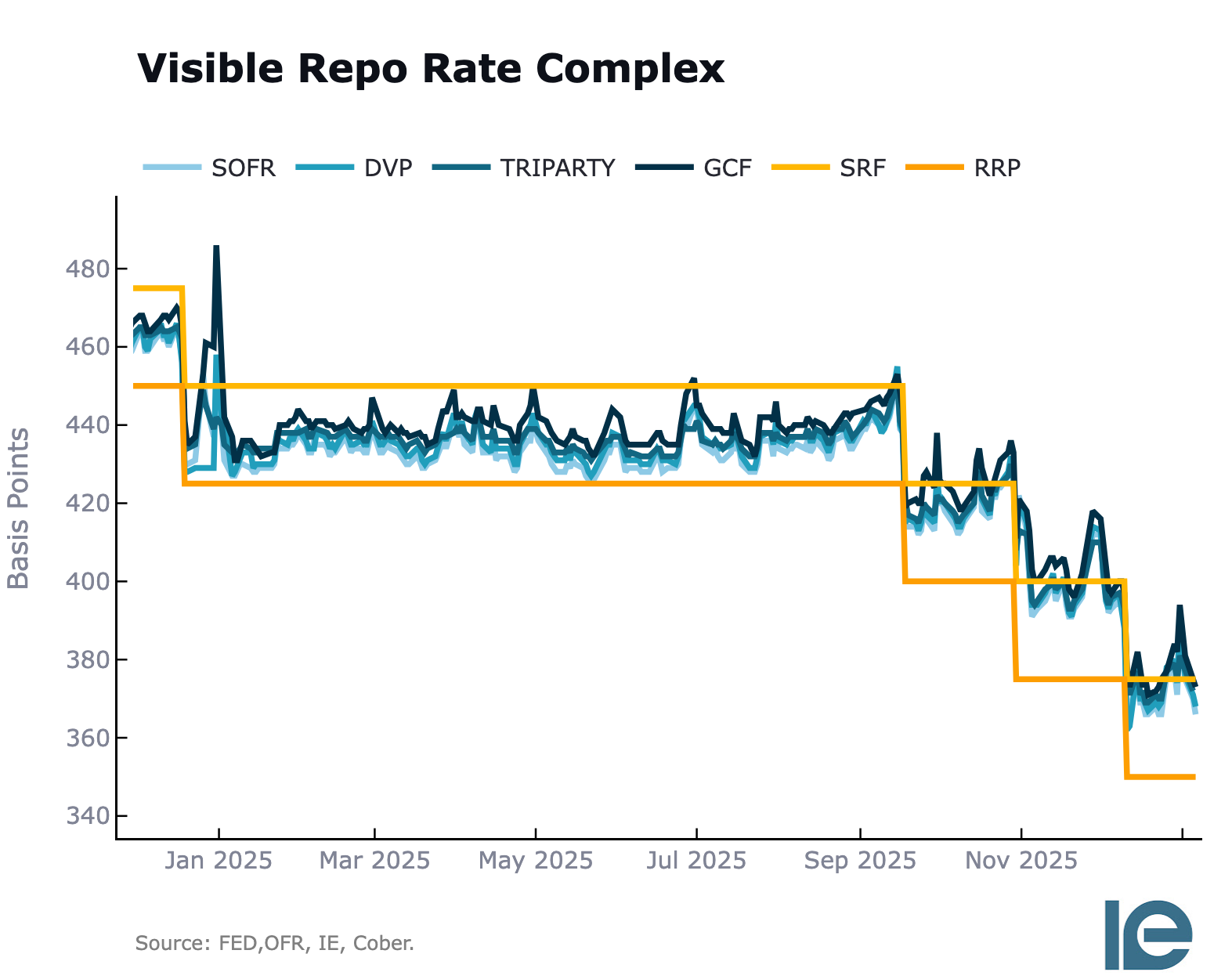

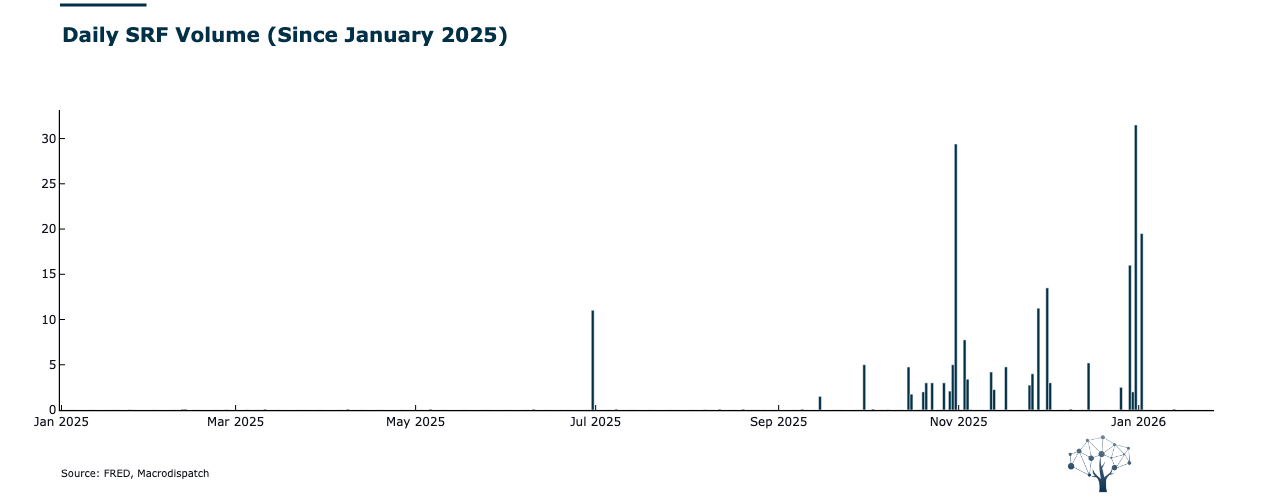

The FED establishes facilities to set boundaries for the overnight rate. The standing repo facility should act as a ceiling.

Primary dealers can always borrow there against Treasury collateral at a known rate, so market rates should never go meaningfully higher.

Why pay more in the market when you can borrow cheaper at the FED?

In theory, it should work, but there are some details that the people who should use this Collateral should know.

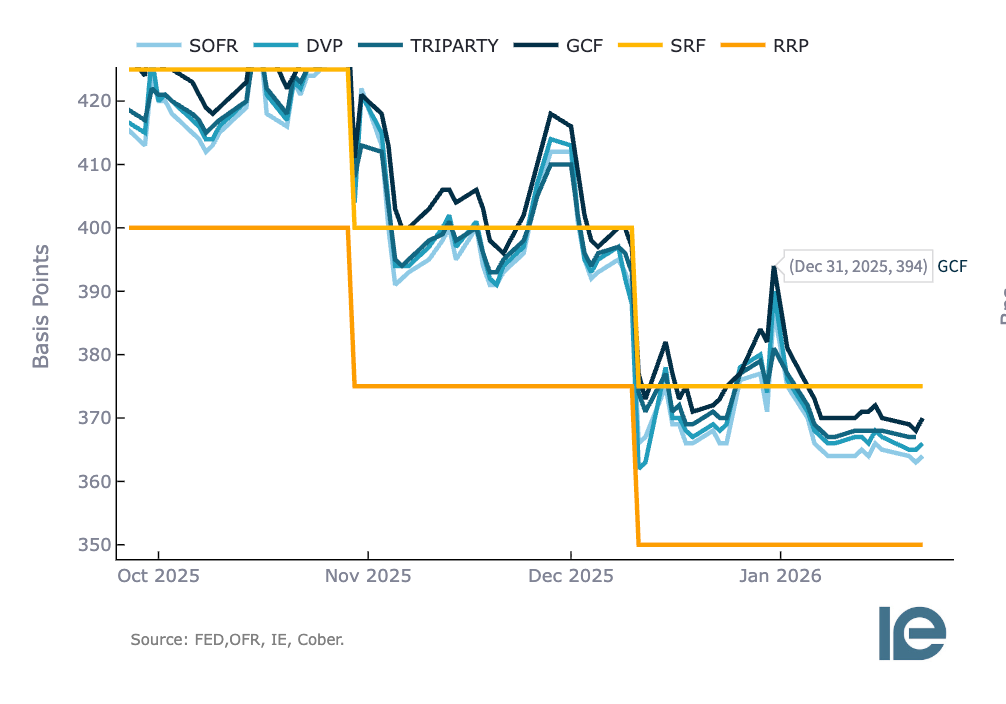

Except throughout 2025, repo rates traded above the standing repo facility constantly. On December 31st of 2024, we saw rates 38 basis points above the facility. Even during regular periods, rates stayed persistently elevated above what should be the upper bound. Quarter and month ends saw the most significant spikes, but the pattern appeared across the board.

Think about how strange this is:

1. The Fed lends at the facility rate.

- Market participants are choosing to pay more elsewhere.

The Fed tried fix the stigma problem, worried that banks avoided the facility because using it might signal distress.

They even renamed it from a standing repo facility to a standing repo program (SRP), hoping a fresh brand would help.

A few billion dollars have flowed through here and there, but these are trivial amounts in a multi-trillion-dollar market.

The honest answer is probably more straightforward and more frustrating: the facility either doesn't serve the right institutions at the correct timing, or the operational friction of accessing it is high enough that paying above-ceiling rates is actually easier.

Either way, the ceiling is still failing its cause and going through iterations to fix it.

It's part of the system that the Primary Dealers have some advantages, access to the Soma portfolio, and an SRP facility.

(More on soma data coming soon)

The Balance Sheet Mechanics

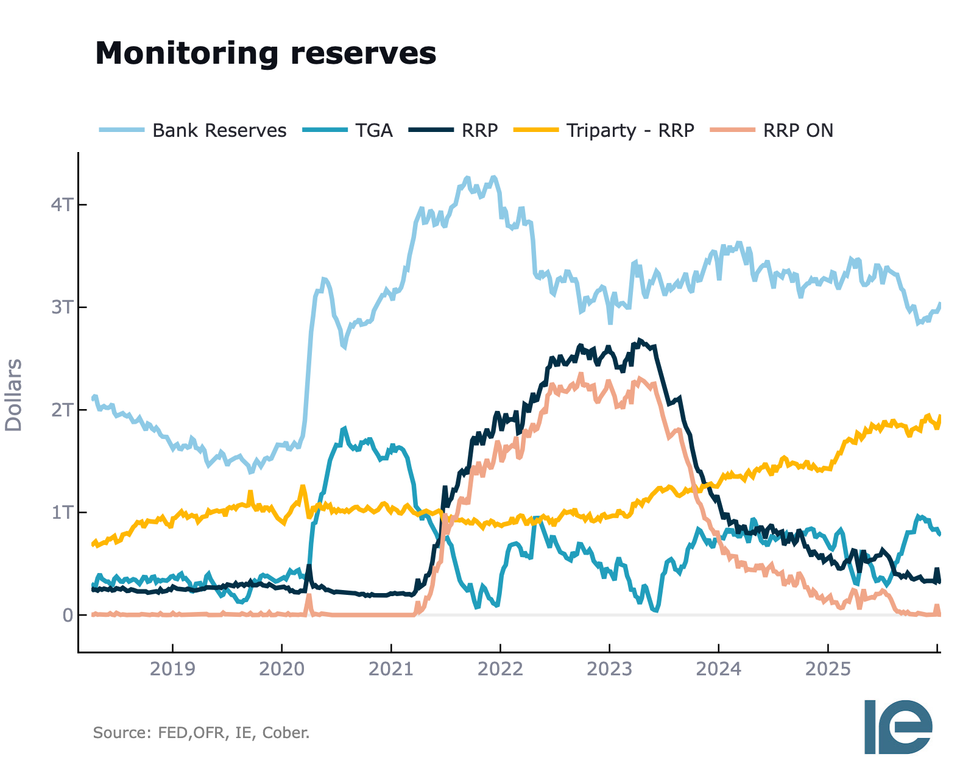

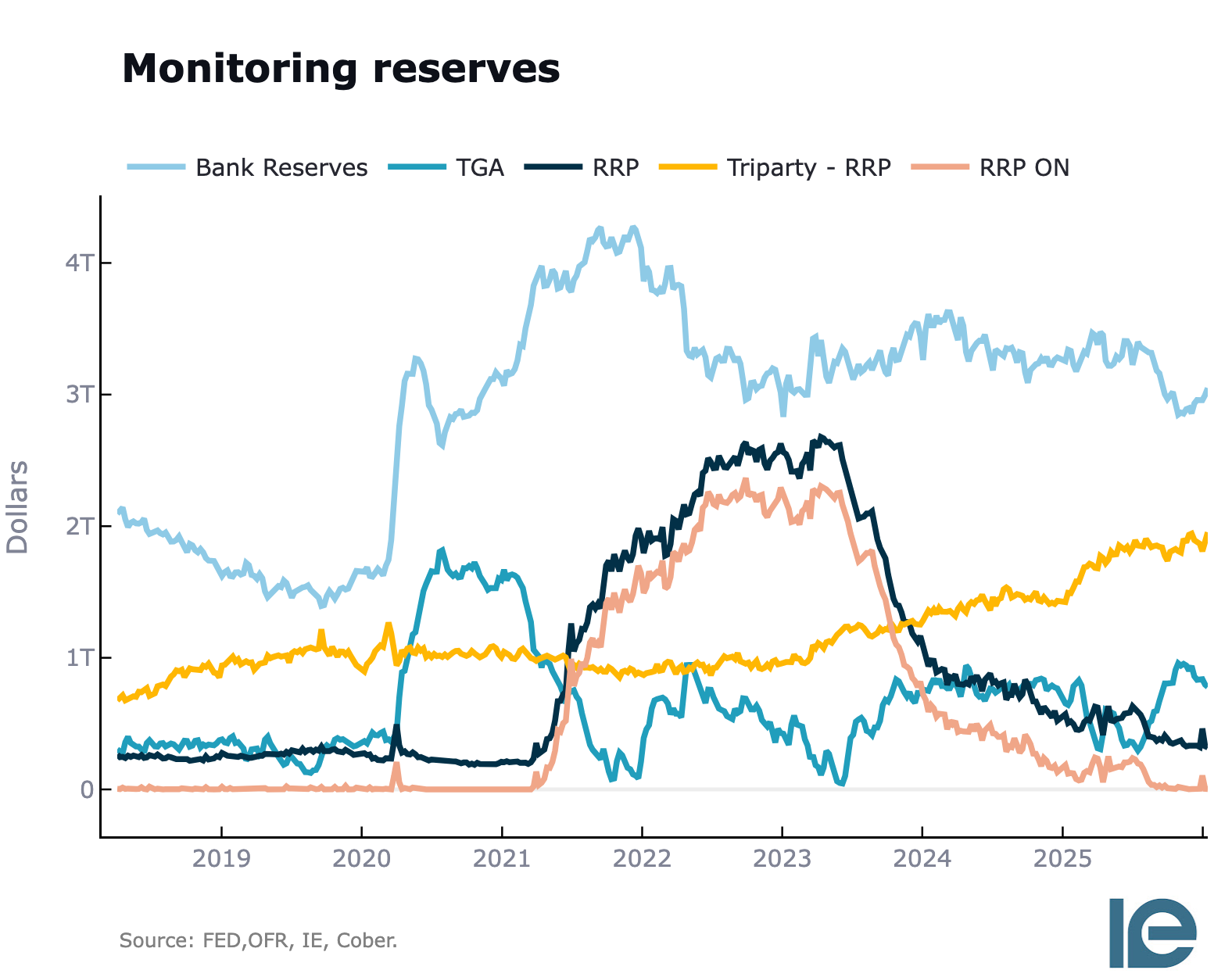

Understanding why reserves became scarce requires following the money through the Fed's balance sheet. The Fed's Quantitative tightening through 2024 meant the Fed sold assets. The Fed withdrew reserves from the system. When the Fed sells a TreFedry bond, it receives payment in reserves that then disappear. Fewer reserves means less cash available for banks and dealers to meet their daily funding needs.

The overnight reverse repo facility, which was drained of trillions at its peak, fell to essentially zero by 2025.

oportunitties arised, therefore excess cash left the facility of the FED going after them.

The Treasury General Account also rebuilt itself, and this drains reserves in a less obvious way. When the U.S. Treasury sells bonds and builds up its cash balance at the FED, those reserves sit in the TGA rather than circulating in the banking system.

Being effectively sterilized, unavailable to meet funding needs until Treasury spends the money.

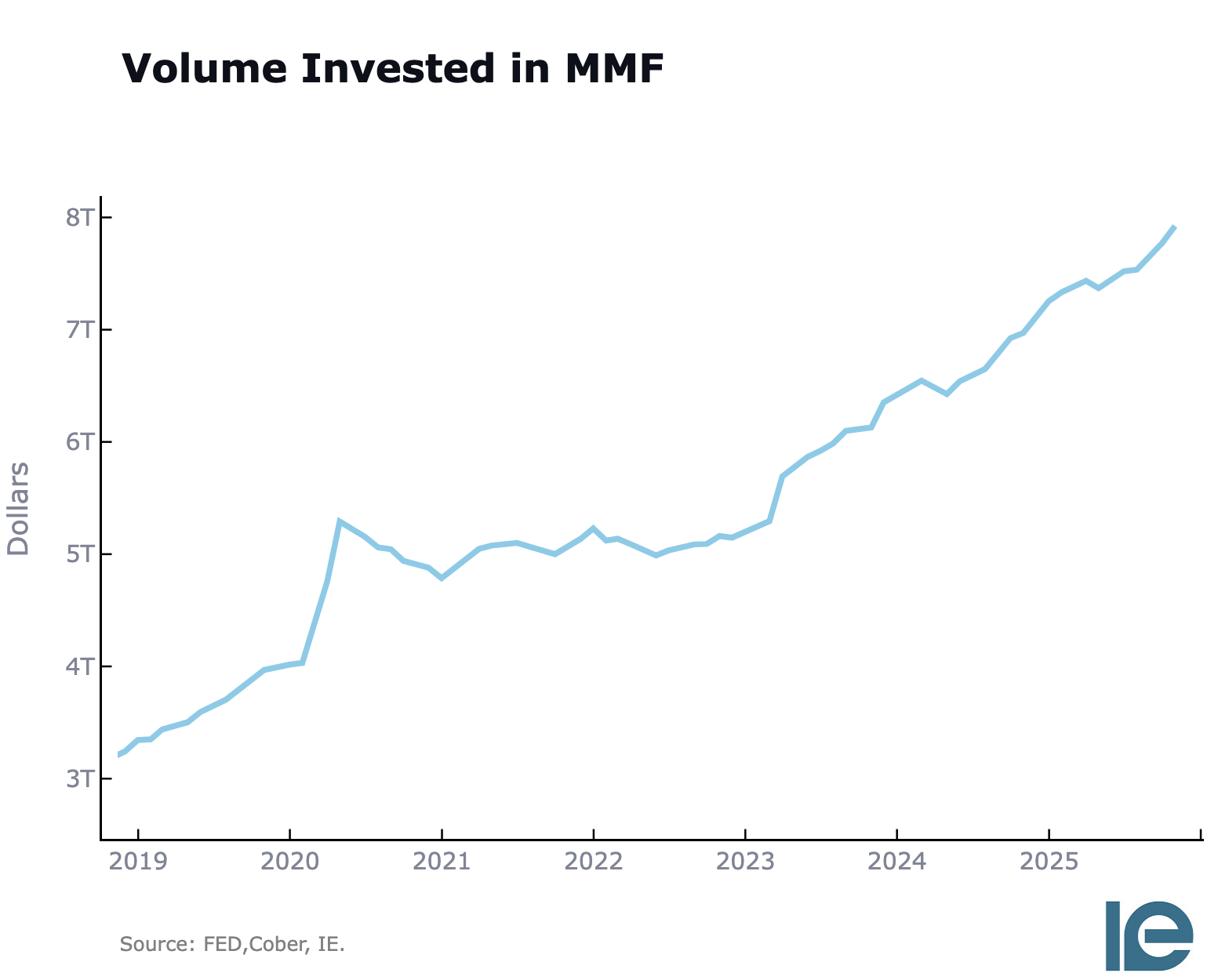

Meanwhile, money market funds grew by roughly a trillion dollars through 2024, reaching over eight trillion.

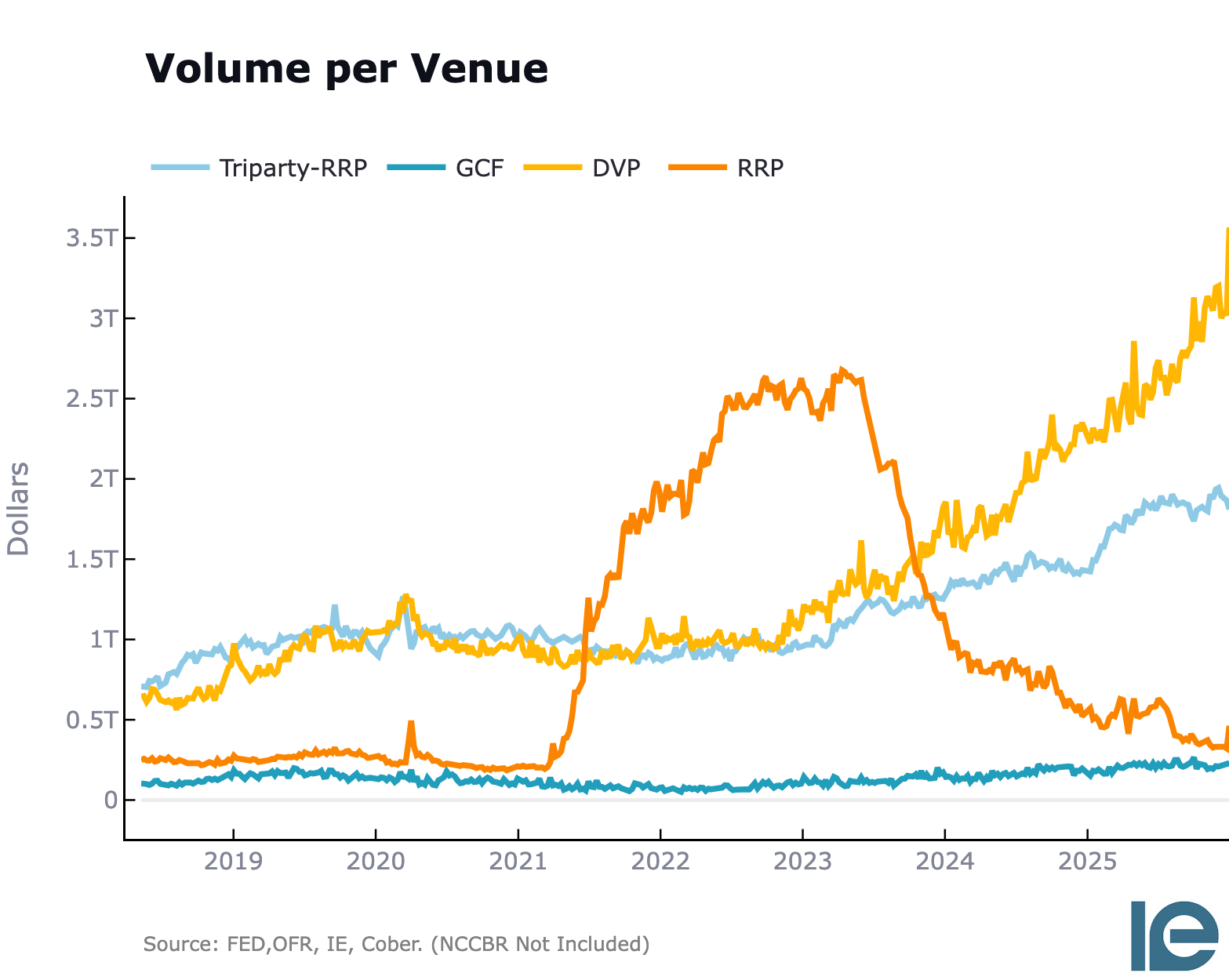

These funds need somewhere to put their cash. They're major players in triparty repo, probably providing around $1.6 trillion in funding to primary dealers. But the total repo market is much larger than this, with daily volume running into multiple trillions. Other funding sources have expanded to fill gaps, but the system as a whole is running tighter.

DVP Exploded, and Dealers Are Stressed

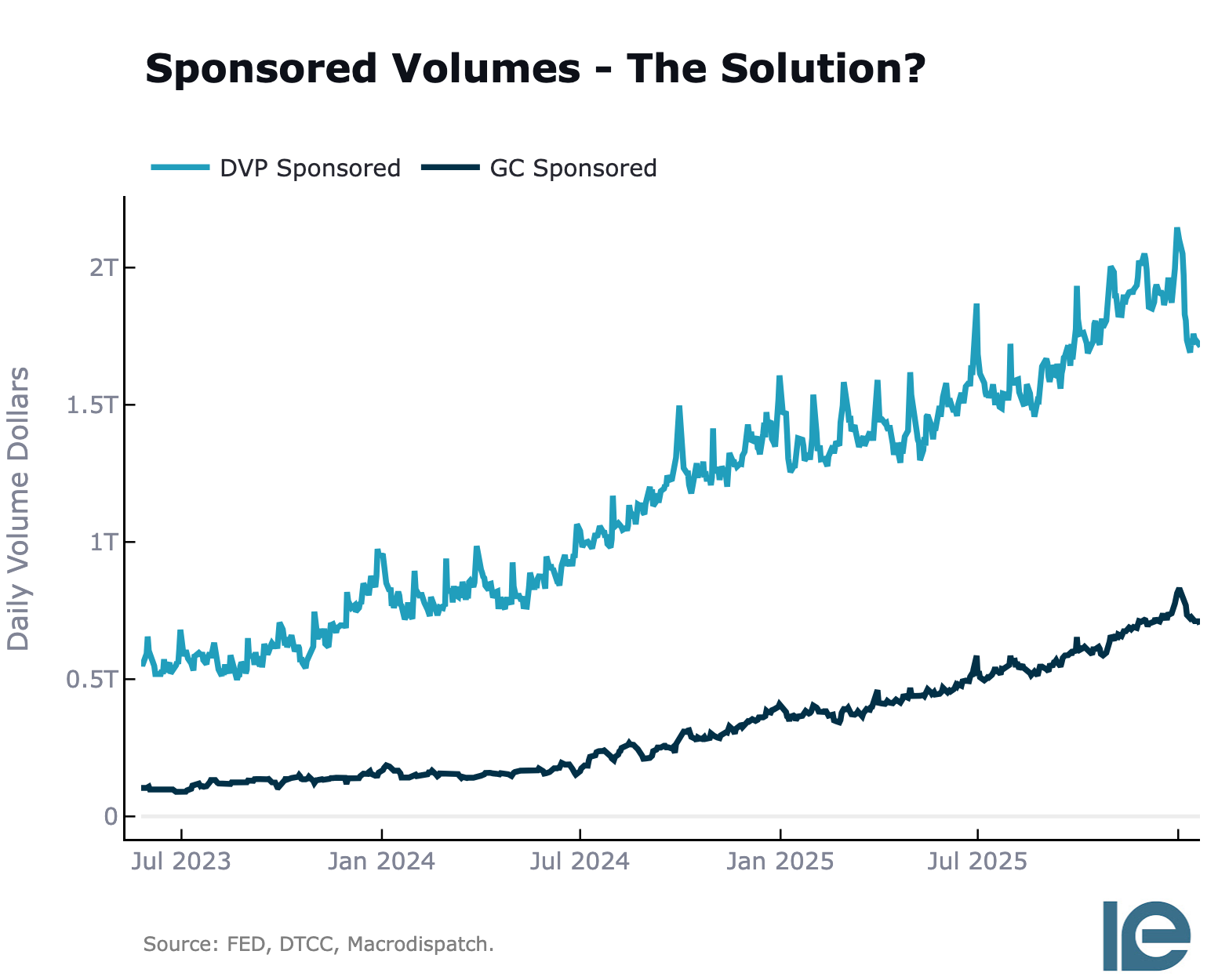

The most dramatic structural shift was the delivery-versus-payment repo, nearly doubling to around $3.5 trillion in daily volume.

Sponsored repo, where dealers bring clients into centrally cleared markets, accounts for over two trillion dollars of this. The remaining $1.5 trillion is non-sponsored DVP activity.

This explosion reflects real economic benefits. Centrally cleared transactions offer better netting and more favorable regulatory capital treatment as Basel III implementation approaches. These aren't small advantages. They translate directly into lower costs and better balance sheet efficiency, which is why volumes doubled despite overall tightness in the system.

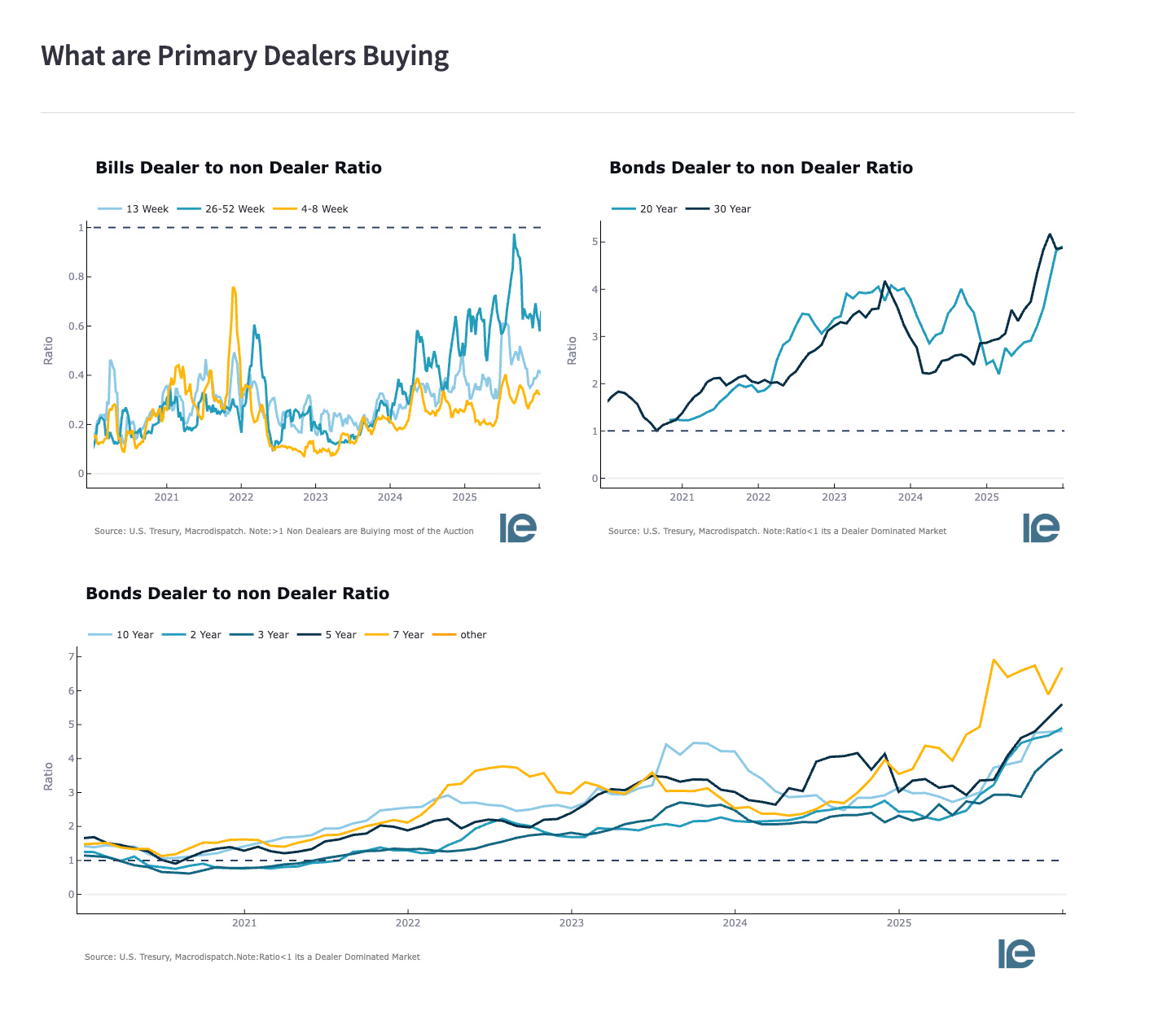

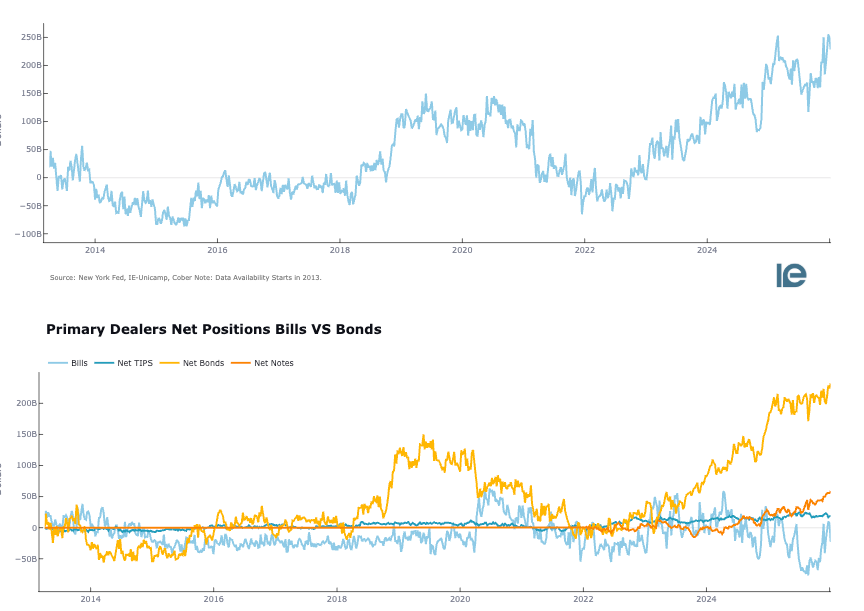

Primary dealers show the strain most clearly. Look at Treasury auction data, and you see dealer-to-non-dealer bid ratios hitting five to one on long bonds and four to one on ten-year Treasury.

These are elevated levels. Dealers are required to bid as primary dealers, but these ratios tell you they're absorbing larger shares of issuance while other buyers step back.

Total Net longs are above 200b; this most likely hedged out via derivatives, but that's not always the case, so it's worth noting.

They have a standing put to intervene if things go sour, and the market knows that.

At quarter and month ends, primary dealers dial back their repo activity to manage their own balance-sheet constraints.

This creates visible seasonal patterns in which Sponsored Repo steps in to fill the gap. The most likely explanation is smaller non-primary dealers, which account for the majority of sponsored repo, bringing in client positions from the NCCBR, which has more favorable rates for this period of the month, since right after the month ends, levels drop.

That said, it's a working theory, and they remain a friction point in the market that reveals underlying stress.

Also worth noting: in January, there's a 400 billion drawdown in DVP-sponsored activity, suggesting lower activity from sponsored members in the market at the start showing a step down on levarage.

This pullback in leverage coincident with a move back to better EOM liquidity, with General collateral repo being below EFFR for the first time since 2024.

What does this mean going forward ?

We're at an inflection point that could resolve in different directions. The Fed has resumed Fedying Treasury bills, gradually adding reserves back into the system.

These purchases are modest, just a few billion on a rolling basis, but they signal the Fed recognizes it has drained reserves too aggressively.

They're trying to add reserves without swinging back dramatically toward the abundant reserve regime that characterized the pandemic years.

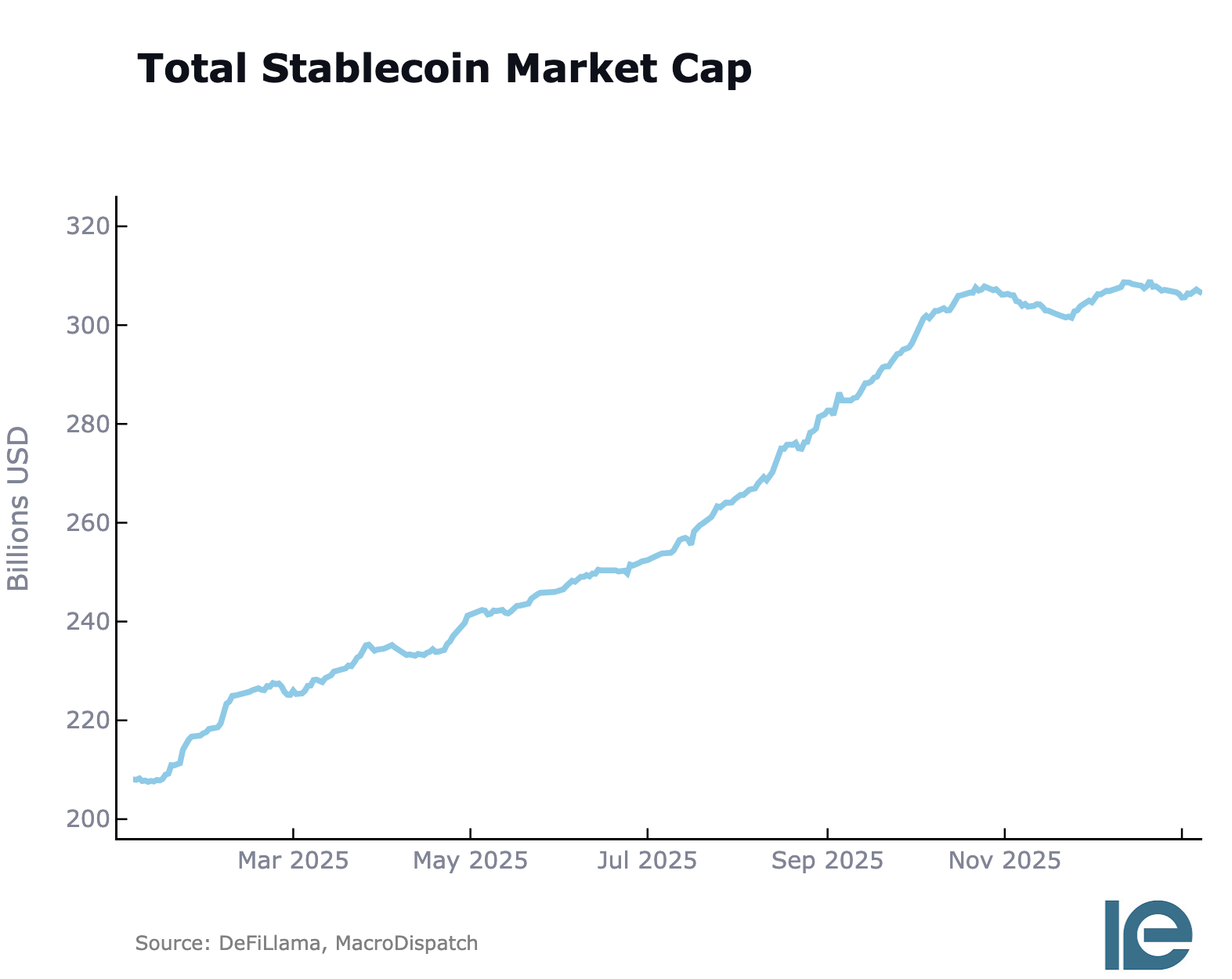

Stablecoins add another complication. They grew from $200 billion to $300 billion through 2024 and continued expanding into 2025. These entities buy Treasury bills to back their coin issuance, creating a new player, which is small for now but worth watching.

Crypto conditions could also change, and aggressive crypto exits could serve as a valve for short-term volatility in bills. That said, as this sector grows, it creates persistent demand for safe short-term assets.

The key question for 2026 is whether we're approaching a stable equilibrium at this level of reserve scarcity or building toward something more acute.

The indicators to watch are the same ones that told us 2025 would be different.

- The dash-for-cash arbitrage shows whether marginal reserves are being bid away.

- The frequency and size of rate breaches above the standing repo facility, now SRP, will tell us whether the ceiling is functioning.

- Quarter-end and month-end rate behavior indicates dealer stress levels.

- Volumes across different repo venues, especially DVP, show how market structure is adapting, and the drain of sponsored shows some deleveraging.

September 2019 showed us what happens when reserve scarcity turns acute. Overnight repo rates spiked above five percent.

The Fed had to intervene aggressively.

We're nowhere near that kind of dysfunction now. Still, we're clearly beyond the comfortable abundance that characterized 2020 through 2023, and the Fed is very aware of what's happening in these markets.

They have a standing put to intervene if things go sour, and the market knows that.

The system is operating in a new regime, one in which reserves and Collateral might matter again and in which the Fed's facility structure shows its limitations.

The repo market spent 2025 learning to speak this new variant of the language of scarcity as we get walked down towards countries' efforts to centralize the treasury market.

Whether the future is stability or strain depends on how well the Fed listens andFedsponds to what the market is saying.

Hope you all enjoyed the reading. You're awesome!

Best,

Cober

As always, the live monitor that updates the data at HERE is free.

They have a standing put to intervene if things go sour, and the market knows that.

Consider donating, sharing, or subbing.

Member discussion